How do I invest in cryptocurrency? This is one of the most frequently asked questions by new investors entering the digital finance space. Cryptocurrency investing has become a popular wealth-building strategy, offering access to high-growth digital assets powered by blockchain technology. With the right approach, even beginners can start investing safely and strategically.

The first step in cryptocurrency investment is understanding what cryptocurrencies are. Digital assets like Bitcoin and Ethereum operate on decentralized blockchain networks, removing the need for traditional financial intermediaries. Bitcoin is often considered a store of value, while Ethereum supports smart contracts, decentralized applications, and financial innovation through DeFi platforms.

Next, investors must choose a reliable cryptocurrency exchange. Popular exchanges offer user-friendly interfaces, strong security features, and access to a wide range of crypto assets. When selecting a platform, prioritize regulation, liquidity, low trading fees, and secure custody options. This step is critical for protecting your investment capital.

Once an exchange account is created, the next step is funding your account. Most platforms allow deposits via bank transfers, credit cards, or digital payment methods. Beginners are advised to start with a small investment and avoid overexposure while learning how the crypto market behaves.

Choosing the right cryptocurrency to invest in is essential. Bitcoin and Ethereum are often recommended for beginners due to their strong market dominance, liquidity, and long-term growth potential. Diversifying into established altcoins can further reduce risk while increasing exposure to innovative blockchain projects.

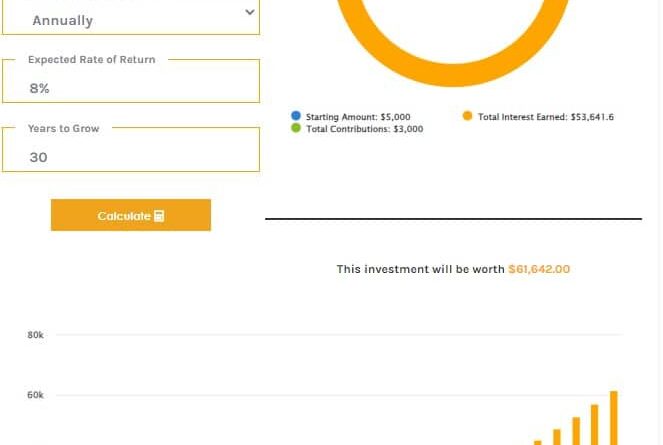

A smart investment strategy is dollar-cost averaging (DCA). Instead of investing a large sum at once, DCA involves investing smaller amounts regularly. This method reduces the impact of market volatility and helps investors build positions over time without trying to time the market.

Security should be a top priority in cryptocurrency investing. Investors should enable two-factor authentication, use strong passwords, and consider transferring assets to hardware wallets for long-term storage. Protecting digital assets is crucial, especially as investment values increase.

Many investors also explore earning passive income through cryptocurrency. Options such as staking, crypto savings accounts, and DeFi lending allow investors to generate returns beyond price appreciation. These strategies can enhance overall portfolio performance when managed carefully.

Understanding taxation and regulation is another important step. Cryptocurrency investments may be subject to capital gains taxes depending on local laws. Keeping accurate records and staying informed about regulatory changes can help investors remain compliant and avoid legal issues.

Conclusion: Investing in Cryptocurrency the Smart Way

Investing in cryptocurrency can be a rewarding financial journey when approached with knowledge, discipline, and long-term vision. By choosing reputable exchanges, diversifying assets, prioritizing security, and applying proven investment strategies, beginners can confidently enter the crypto market. As blockchain technology continues to reshape the global economy, cryptocurrency investment offers a powerful opportunity to participate in the future of digital finance.